Although merely “1 Gold Share” from the government, PUNCAK NIAGA, an important privatized company that constitute the 70% share and an active shareholder of SYABAS1, may be another AIG during the financial economics crisis, i.e., being bailed up by the government2. Since MARC downgraded SYABAS bond rating3, there had been a speculation that these bonds, being largely hold by domestic banks, will likely to be resold to the government. Questions have been raised about this bail out plans.

Similar to AIG vs Fed, the reason why SYABAS is bailed out because it is widely believed that if SYABAS bonds default, its bond holders – the banks- would lose some RM11bn which may subsequently cause a fall in willingness to lend by these banks. Similar to its former counter-part, this nationalism move was contrary to the New Economics Model (NEM) unveiled in early 2010 by Najib’s administration4. Another similarity they both have in common is that both “Man of the Corporate” have a controversial high pay. SYABAS’ Executive Chairman, Tan Sri Rozali Ismail, was allegedly paid at RM425 000 per month5 in contrast to the current Malaysia Prime Minister, who is merely getting paid approximately twenty thousand Malaysian Ringgit per month.6

Nevertheless, there is some dissimilarity between these two intercontinental firms. For the past decades, AIG had been both boom and burst. SYABAS on the other hand, was an ailing business. Although there wasn’t a direct source presented that, but the recent move made by MARC on SYABAS bonds could be suggesting the company’s failures in last few years, even with the reform made by government in 2003, are indeed, probable. In contrast to that belief, SYABAS might be doing not as bad as the press suggested. Rozali, amid his high salary, has been awarded numerals of awards, and one of them being the Asia water Management Award, being 5 of the national oligopolies in Malaysia7. On top of that, when Tan Sri was asked about his pay package, he dully replied:

“…If they want professionals to run the company, they will have to pay.”8

The question is, have the high paying “professionals” produced a reasonable profit for the company? With the recent bailing out request and its subsequence approval may indicating the otherwise.

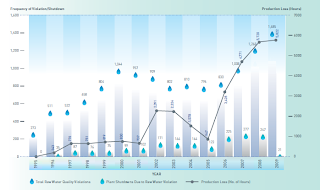

SYABAS’ failure does not end with its high paying executives. Its failure also constitutes by its inefficiencies and the way SYABAS conduct their business ethic and being circumvented by the Federal Government. The inefficiency in SYABAS is rather obtrusive. Selangor, the state with rather well developments and second only to its neighbour Kuala Lumpur, has given SYABAS the responsibility to be the Selangor concessionaire. Despite the significant developmental growth in the region, SYABAS was not able to reap that profit. As with other providers’ main concern, SYABAS’ top concern was the loss of water from the network. Such problem is topped by lack of knowledge on the lay-out and operation of the pipe networks. In one research shows that approximately 35% of the water disappears before reaching the households compare to the national average Non-Revenue Water (NRW), which is currently at about 37%. This means that the amount of lost water under SYABAS represents all of Denmark’s water usage in one year. 9

(Table 1: SYABAS Production Loss and Violation Frequency 1995-2009) 10

Inefficiency isn’t the only problem with SYABAS. Its alleged internal and political corruptions also may have suggested the bold bailout package designed by the government. An audit report on SYABAS showed more than 72% of contracts worth RM600m were awarded to companies chosen through direct negotiation and not by open tender process.11 On top of that, RM325m has vanished when an audit was conducted on SYABAS contracts and its public account in year 2005 to 2007.12 In mid-2006, SYABAS broke the agreement by using imported pipes from Indonesia. Coincidentally, or not, the supplying company was allegedly owned by Tan Sri Rozali Ismail, the very executive chairman of SYABAS itself.13 If these allegations were true, then Syabas to SYABAS for having a vertical integration. Nevertheless, Rozali reportedly reaped some RM300m from the deal14, from SYABAS itself, a company which the government subsidised. This ‘missing play’ isn’t new to public organisations especially in Malaysia where its Corruption Perception Index (CPI) ranks right below South Africa and Kuwait.15 However, this level of corruption is rarely a scene to a privatised firm where efficiency is supposed to be high. Besides that, SYABAS also have a tendency to spend over budget the government organisation imposed. RM50m was spent for its office renovation despite Jaban Kawalselia Air Selangor (JKAS) only approved a budget of RM20m.16 Such propensity to overspend certainly puts a doubt in anyone who would save the ailing firm, all but our federal government, who is ready to bailout the company.

On a side note, the inability for SYABAS to pay to its bond holders should be questioned amid the lawsuits that SYABAS is currently undergoing.17Although seeking compensation worth approximately RM1bn from Selangor government, the ability and the will to pursue such expensive gamble makes its current financial situation be questioned; are they really at wit’s end? Or the federal is just has the constant interest to protect its former President of Chamber of the Malay Commerce in Selangor. SYABAS is the frequent refugee of the federal government’s bunker. During the 2008 Selangor-SYABAS proposal, the federal government decided to intervene in favour of SYABAS while campaigning over privatisation via NEM18.

For the record, SYABAS isn’t all that grey. It has, indeed, invested in several developmental researches. Its recent purchase of an improvement package from AQUIS could be a proof to this.19 However, given SYABAS past history in investing either in an ailing project or overspent in an unnecessary packages, such investment could be yet another hollow action. This constant helping hand from federal government, as Prime Minister Najib would have put it, an ‘opium’ to SYABAS. However, if this bailout plan is passed, and it is likely to be, SYABAS should make its annual reports and contracts available to the public as it would then be a public interest, especially to the anti-Capitalist scholars would who keen to prove the failure of privatisations.

Matthew.

p/s the weird numbers are citations ^^

Reference, (not done)

1, Corporate structure: shareholders http://www.syabas.com.my/maincorp.php?pg_post=3&pg_id=1&menu_id2=2

2, SYABAS bailout a blow to privatisation http://malaysianewsnetwork.net/portal/2011/05/syabas-bailout-a-blow-to-privatisation/

3, Selangor water sector debt rating 2011 http://www.marc.com.my/ratbase/pub.report.detail.php?aid=3940&returnPath=%2Fratbase%2Fpub.report.view.php&returnPathStr=coid%3DSYABASa

4, Private Sector In Driver's Seat A Good Shift In NEM". Bernama. 31 March 2010

5, New Straits Times, 18 March 2009

6, Members of Parliament (Emolument) (Amendment) Act 2005

7, Biography of Tan Sri Rozali Ismail http://www.syabas.com.my/mainpeople.php?pg_post=3&pg_id=2&menu_id2=3

8, New Straits Times, 18 March 2009

9, Kuala Lumpur-SYABAS part one http://www.7t.dk/products/aquis/references/kuala_lumpur.aspx

10, Puncak Niaga Annual Report 2009 part 2 page 128(8) http://announcements.bursamalaysia.com/EDMS/subweb.nsf/7f04516f8098680348256c6f0017a6bf/234b864360bae0ed48257735003f7134/$FILE/PUNCAK-Page%20121%20to%20ProxyForm%20%282MB%29.pdf

11,12,13,14,16 Selangor water http://anilnetto.com/economy/malaysian-financebusiness/selangor-water-return-control-to-the-people/

15, "CPI 2010 table". Transparency International. http://www.transparency.org/policy_research/surveys_indices/cpi/2010/results

17, SYABAS to sue Selangor MPs http://www.themalaysianinsider.com/malaysia/article/syabas-to-sue-klang-mp-for-defamation/

18, Kuala Lumpur-SYABAS part two http://www.7t.dk/products/aquis/references/kuala_lumpur.aspx

No comments:

Post a Comment